4 Terms

4 TermsHome > Industry/Domain > Banking; Business services > Mergers & acquisitions

Mergers & acquisitions

Referring to the aspect of corporate strategy, finance and management that deals with the buying, selling or combining of different companies that can assist a growing company to grow rapidly without having to create another business entity.

Industry: Banking; Business services

Add a new termContributors in Mergers & acquisitions

Mergers & acquisitions

Business strategy or model

Banking; Mergers & acquisitions

That portion of a business plan detailing the way the firm intends to achieve its vision.

Business-level strategies

Banking; Mergers & acquisitions

Strategies pertaining to a specific operating unit or product line within a firm.

Business alliance

Banking; Mergers & acquisitions

A generic term referring to all forms of business combinations other than mergers and acquisitions.

Effective control

Banking; Mergers & acquisitions

Control achieved when one firm has purchased another firm's voting stock; it is not likely to be temporary. There are no legal restrictions on control such as from a bankruptcy court, and there are ...

Due diligence

Banking; Mergers & acquisitions

The process by which the acquirer seeks to determine the accuracy of the target's financial statements, evaluate the firm's operations, validate valuation assumptions, determine fatal flaws, and ...

Employee stock ownership plan (ESOP)

Banking; Mergers & acquisitions

A trust fund or plan that invests in the securities of the firm sponsoring the plan on behalf of the firm's employees. Such plans are generally defined contribution employee-retirement plans.

Dual class recapitalization

Banking; Mergers & acquisitions

A takeover defence in which a firm issues multiple classes of stock in which one class has voting rights that are 10 to 100 times those of another class. Such stock is also called supervoting stock.

Featured blossaries

cristina cinquini

0

Terms

2

Blossaries

0

Followers

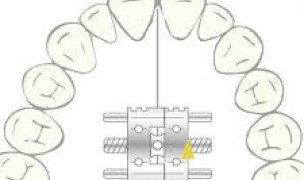

orthodontic expansion screws

4 Terms

4 Terms