10 Terms

10 TermsHome > Industry/Domain > Financial services > Real estate investment

Real estate investment

Industry: Financial services

Add a new termContributors in Real estate investment

Real estate investment

Basis

Financial services; Real estate investment

Basis is the cost of property at the time of its acquisition. It is used under the Internal Revenue Code for the purpose of computing gain, loss and depreciation with respect to the property, I.R.C. ...

Accrued depreciation

Financial services; Real estate investment

Accrued depreciation is the difference between the cost of replacing new property and the present market value of the property.

Active income

Financial services; Real estate investment

Active income is all taxable income of a taxpayer except income from a passive activity and portfolio income. Passive activity is something in which the taxpayer does not actively take part, and ...

Additional first-year depreciation allowance

Financial services; Real estate investment

The additional first-year depreciation allowance is a depreciation allowance equal to 20 percent of the cost of certain depreciable personal property. This allowance applies only to property placed ...

Adjusted basis

Financial services; Real estate investment

Basis is the cost of an asset or some substitute for cost. Adjusted basis is the basis, plus or minus certain adjustments such as expenditures, receipts, losses, and depreciation, I.R.C. § 1016.

Asset depreciation range (ADR) system

Financial services; Real estate investment

The Asset Depreciation Range (ADR) System is a method of determining the allowance for depreciation by assessing the useful life of the property according to published guideline life ranges, I.R.C. § ...

After-tax investment

Financial services; Real estate investment

After-tax investment is the actual cost, after tax benefits, of the investment. It is often referred to as hard dollar investment.

Featured blossaries

marija.horvat

0

Terms

21

Blossaries

2

Followers

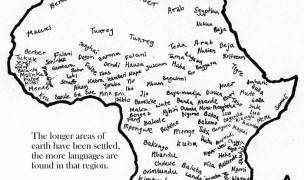

The worst epidemics in history

20 Terms

20 Terms