10 Terms

10 TermsHome > Terms > English, UK (UE) > Random walk

Random walk

Impossible to predict the next step. Efficient market theory says that the prices of many financial assets, such as shares, follow a random walk. In other words, there is no way of knowing whether the next change in the price will be up or down, or by how much it will rise or fall. The reason is that in an efficient market, all the information that would allow an investor to predict the next price move is already reflected in the current price. This belief has led some economists to argue that investors cannot consistently outperform the market. But some economists argue that asset prices are predictable (they follow a non-random walk) and that markets are not efficient.

- Part of Speech: noun

- Synonym(s):

- Blossary:

- Industry/Domain: Economy

- Category: Economics

- Company: The Economist

- Product:

- Acronym-Abbreviation:

Other Languages:

Member comments

Terms in the News

Featured Terms

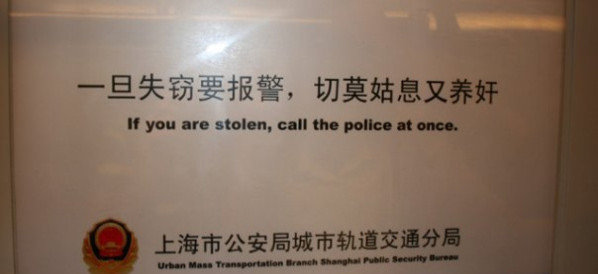

If you are stolen

If you have anything stolen, please contact the police immediately.

Contributor

Featured blossaries

farooq92

0

Terms

47

Blossaries

3

Followers

Top 10 University in Beijing, China

10 Terms

10 Terms

Browers Terms By Category

- General astronomy(781)

- Astronaut(371)

- Planetary science(355)

- Moon(121)

- Comets(101)

- Mars(69)

Astronomy(1901) Terms

- General astrology(655)

- Zodiac(168)

- Natal astrology(27)

Astrology(850) Terms

- Health insurance(1657)

- Medicare & Medicaid(969)

- Life insurance(359)

- General insurance(50)

- Commercial insurance(4)

- Travel insurance(1)

Insurance(3040) Terms

- Algorithms & data structures(1125)

- Cryptography(11)

Computer science(1136) Terms

- Industrial automation(1051)